Which of the Following Is Not a Cash Equivalent

They are not cash equivalent. Savings account fund to be used to retire bonds D.

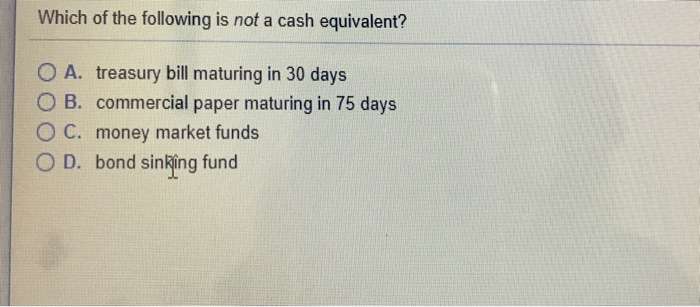

Solved Which Of The Following Is Not A Cash Equivalent A Chegg Com

The buyers of such an asset class must be easy to access.

. Money market fund securities C. 180-day note issued by a local Or state government. Which of the following is not considered as a cash equivalent.

Undeposited credit card sales receipts B. Answer choices A three- year treasury note maturing on January 31 of the next year purchased by the entity on December 1 of the current year. A 60-day money market placement.

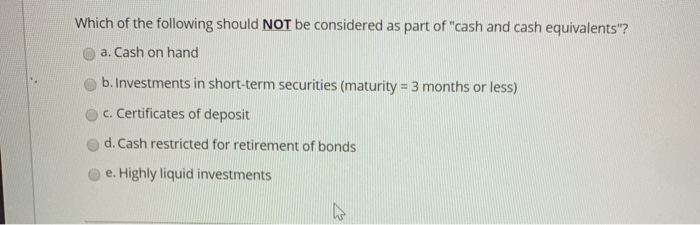

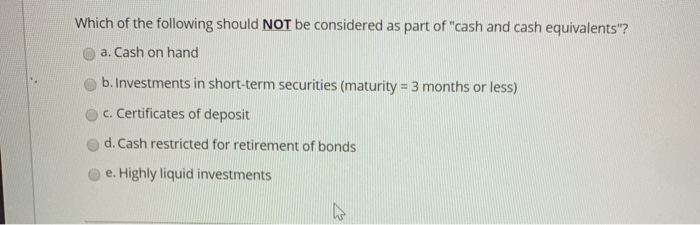

31 of the next year purchased by the entity on Dec. Cash and cash equivalents is a line item on the balance sheet stating the amount of all cash or other assets that are readily convertible into cash. While receivables are often considered cash equivalent or near-cash in financial ratios they are not.

Equity investments are excluded from cash equivalents unless they are in substance cash equivalents for example in the case of preferred shares acquired within a short period of their maturity and with a specified redemption date. Undelivered checks to trade suppliers. Postdated checks and IOUs.

Cornerstones of Financial Accounting 2nd Edition Edit edition Solutions for Chapter 4 Problem 10MCE. Which of the following item is not considered as cash equivalents. Cash and cash equivalents must be current assets.

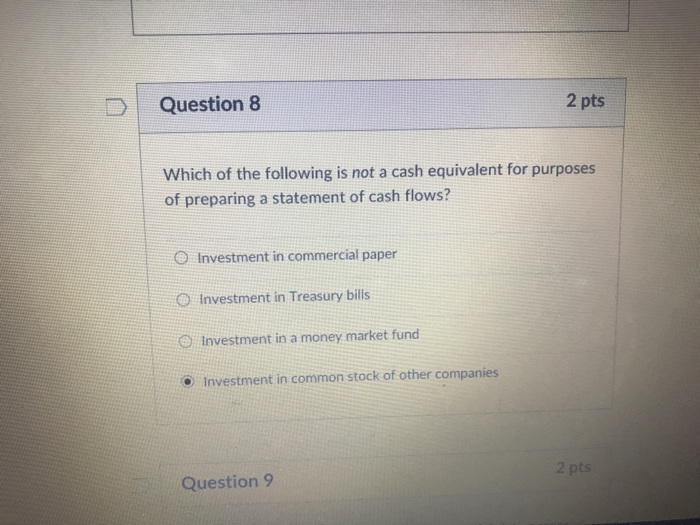

Whats Not Included in Cash Equivalents. 0 Investment in commercial paper 0 Investment in Treasury bills Investment in a money market fund O Investment in common stock of other companies Question 9 2 pts. They include bank certificates of deposit bankers acceptances Treasury bills commercial paper and other money market instruments.

Petty cash funds and change funds B. Cash Equivalents are short-term highly liquid investments that are readily convertible into known amount of cash and which are subject to an insignificant risk of change in value. 1 of the following should not be considered cash for financial reporting purposes.

Reporting entities are required to disclose 1 the nature of restrictions on cash balances and 2 how the statement of cash flows reconciles to the balance sheet when the balance sheet includes more than one line item of cash cash equivalents and restricted cash. Preferred shares of equity can also be considered as an example of a cash equivalent. These assets are listed as investments on the balance sheet.

Which of the following is most likely not be considered as cash for financial reporting purposes. 1 of current year. Bank drafts and money orders B.

Money orders certified checks and personal checks C. A 3-year treasury note maturing on Jan. Any items falling within this definition are classified within the current assets category in the balance sheet.

A companys combined cash or cash equivalents. Which of the following could not be reported as cash or cash equivalents a Money from ACCOUNTING 310 at Technological Institute of the Philippines. Certificate of deposit can be considered as cash equivalent provided the maturity date is less than 90 days.

Dont Be Fooled. Investments in liquid securities such as stocks bonds and derivatives are not included in cash and equivalents. In other words accounts receivables are short-term lines of credit that a business owner extends to the customer.

SURE ILL PASS CORPORATION held the following investments at year-end and you are to compute the cash and cash equivalents. D Question 8 2 pts Which of the following is not a cash equivalent for purposes of preparing a statement of cash flows. Stale checks issued to creditors C.

1 of the current year. 30-day certificate of depositb. 2000 shares of Holdings common stock purchased at P45 per share with a current market value of P4950 per share.

Cash equivalents are the total value of cash on hand that includes items that are similar to cash. Accounting questions and answers. Accounts Receivable Are Not Cash Equivalents.

31 of the next year purchased by the entity on Oct. Further as per Para 8 of IndAS7 Bank borrowings are generally considered to be financing activities. Which of the following should be considered cash.

6536 Disclosure of restricted cash. Even though such assets may be easily turned into cash typically with a three. Coin currency and available funds D.

60-day corporate commercial paperc. Post-dated checks from customers D. A Bank Overdraft b Commercial Papers c Treasury Bills d.

Which of the following is not considered as a cash equivalent. Which one of the following is not a cash equivalent. Which one of the following is not a cash equivalenta.

Treasury bill commercial papers and short-term bonds are also an example of a cash equivalent. Even though these assets may be easily turned into cash typically with a three-day settlement period they are still excluded. A90-day treasury bill b30-day certificate of deposit c180-day note issued by a local or provincial.

A 3-year treasury note maturing on Jan. Cash equivalents are any short-term investment securities with maturity periods of 90 days or less. Cash includes legal tender bills coins checks received but not deposited and checking and savings accounts.

P10000 worth of commercial paper from BA Finance paying an interest rate of 8. Investments in liquid securities such as stocks bonds and derivatives are not included in cash and equivalents. Which of the following would NOT be considered a cash equivalent.

Which Of The Following Is Not Considered A Cash Equivalent Select One A Accounts Receivable B Homeworklib

Solved D Question 8 2 Pts Which Of The Following Is Not A Chegg Com

Solved Which Of The Following Should Not Be Considered As Chegg Com

No comments for "Which of the Following Is Not a Cash Equivalent"

Post a Comment